Description

About this loan type

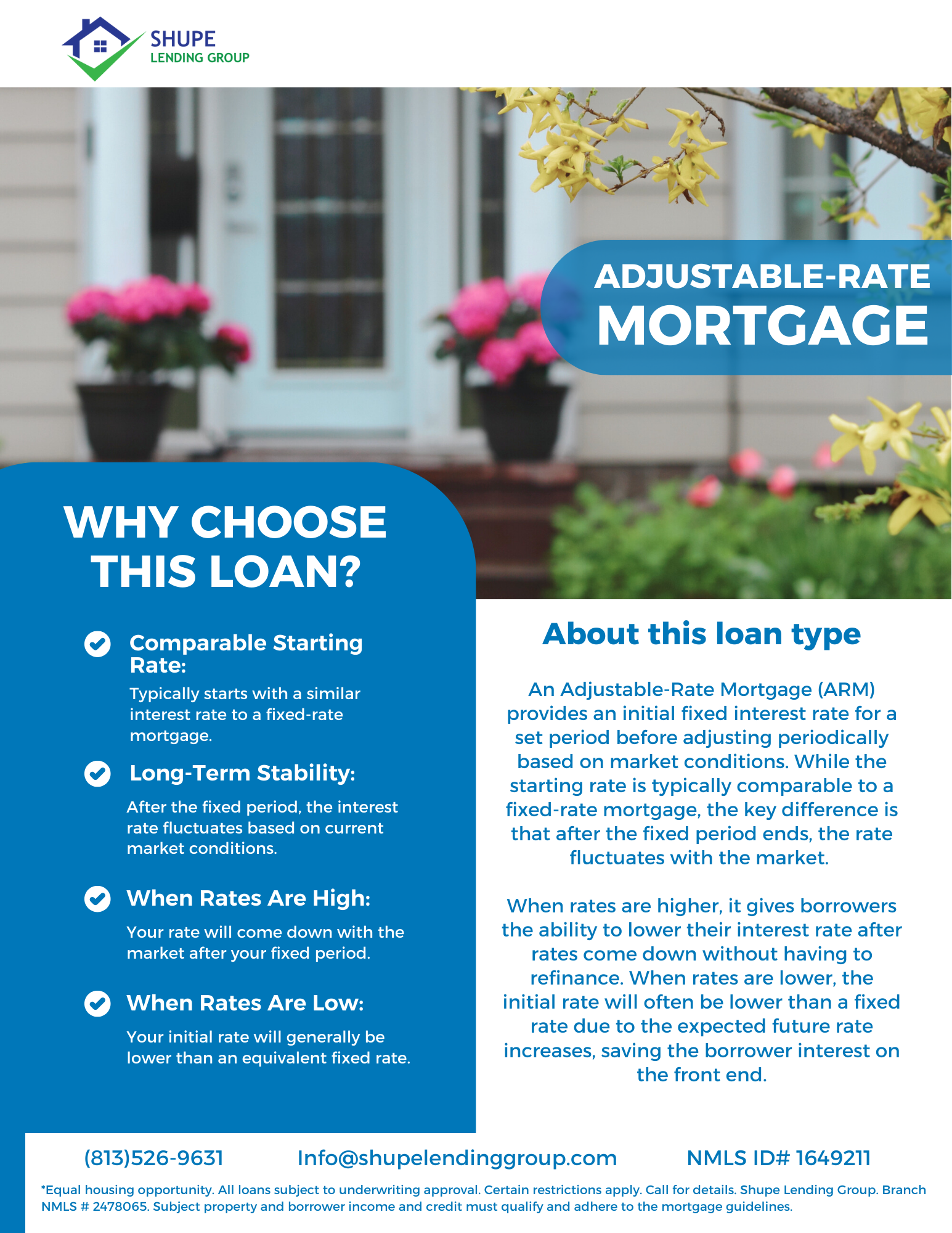

An Adjustable-Rate Mortgage (ARM) provides an initial fixed interest rate for a set period (e.g., 3, 5, 7, or 10 years) before adjusting periodically based on market conditions. While the starting rate is typically comparable to a fixed-rate mortgage, the key difference is that after the fixed period ends, the rate fluctuates with the market. When rates are higher, it gives borrowers the ability to lower their interest rate after rates come down without having to refinance. When rates are lower, the initial rate will often be lower than a fixed rate due to the expected future rate increases, saving the borrower interest on the front end.

Why Choose This Loan?

-

Comparable Starting Rate: Typically starts with a similar interest rate to a fixed-rate mortgage.

-

Rate Adjustments: After the fixed period, the interest rate fluctuates based on current market conditions.

-

When Rates Are High: Your rate will come down with the market after your fixed period.

-

When Rates Are Low: Your initial rate will generally be lower than an equivalent fixed rate.

Reviews

There are no reviews yet.